THE PROBLEM

In our hyper-competitive industry, adaptive markets force participants into continuous transformation. To stay competitive, investment professionals need to optimise all influencing factors to their advantage, just like professional athletes do. All components of an investment decision are comprehendible through optimised skill and decision management within a professional investment process. A structured approach to this innovative specialisation is significantly under-appreciated, thus underdeveloped in our industry.

THE SOLUTION

Through advanced behavioural and quantitative analysis, rigorous scientific research and unparalleled industry experience, our unique skill and decision management solutions coach Investment Athletes with unprecedented precision. Following our core principles of integrating human intelligence and artificial intelligence in an ethical and sustainable way, performance excellence becomes an inevitable reality.

INVESTMENT ATHLETES IN ACTION

How do we do it? For all Investment Athletes to perform best, certain prerequisites need to be met. We create this environment for optimal skill and decision management. Based on our unique taxonomy of investment management skills, we configure individualised development paths. We then optimally aligned the team setting and the choice architectural design to support these paths. This results in an Investment Athlete-centred approach to performance empowerment.

STEP ONE / ONBOARDING

We start with a meticulous onboarding assessment of the individual Investment Athlete and how he/she is embedded in the team and the related choice architecture of the investment process (= decision design). At the end of the onboarding, we have configured an individualised development path for the Investment Athlete and have also explored areas of improvement for the decision design.

STEP TWO / COACHING

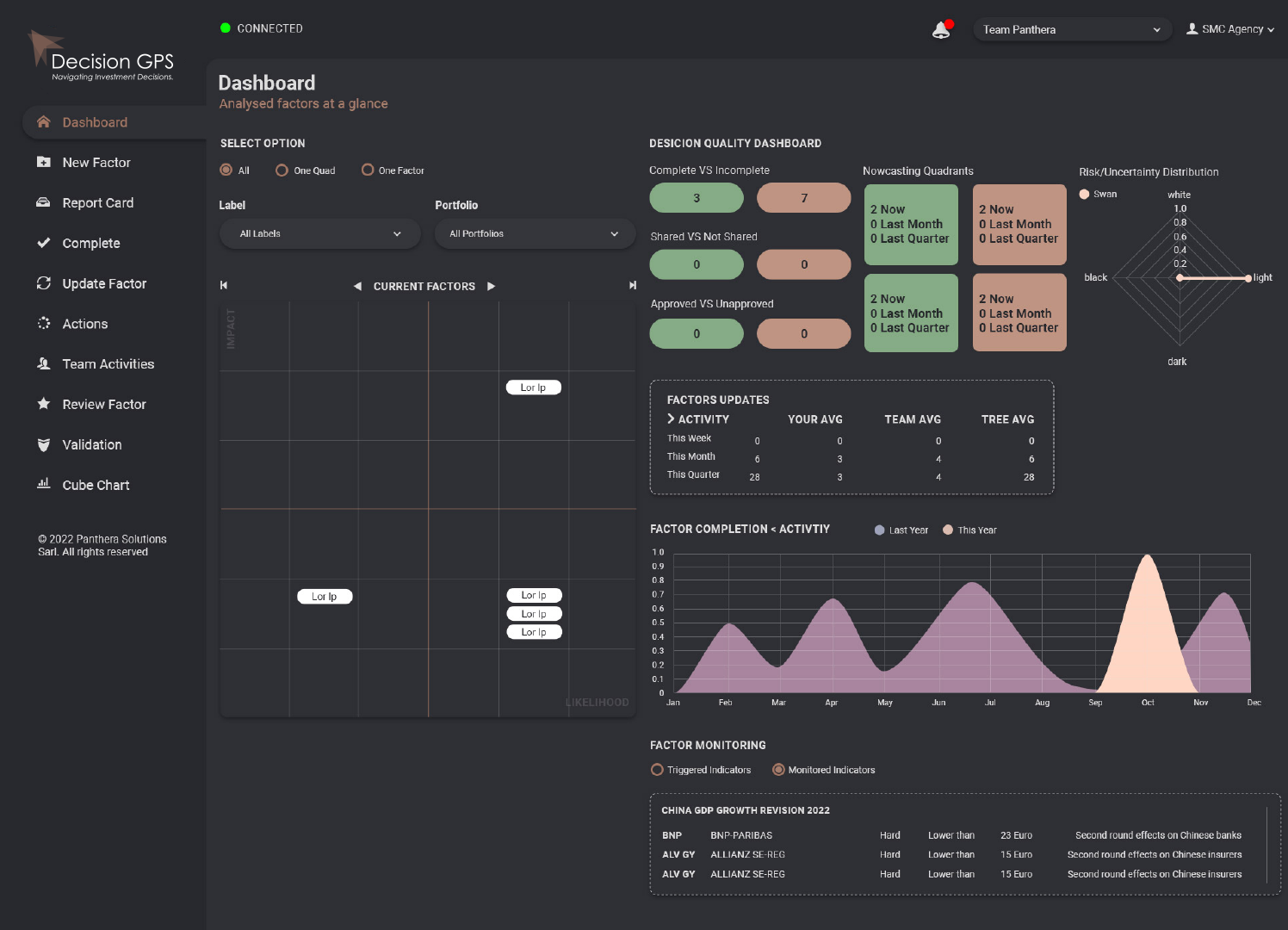

The onboarding insights enable us to start the coaching along the individualised development paths, using our unique skill management platform, the Panthera Academy, and its pool of learning modules. We utilise those advanced skills in an improved decision design (setting of team and choice architecture) that produces most evidence-based investment decisions. The decision design is addressed by our Panthera Tree, an AI-guided decision management platform. It helps Investment Athletes to focus on continuously producing most evidence-based investment decisions. As a habit-forming technology it integrates knowledge management, learning and compliance aspects, allowing Investment Athletes to consistently apply the right assessment method for different uncertainty and risk types. It is an overlay technology that works alongside existing portfolio and risk management software. The ingenuity of its behavioural design allows Investment Athletes to benefit from preventive behavioural bias control, lower costs, increased compliance and a measurably improved investment decision quality.

THE RESULT

We continuously measure quantitative and qualitative KPIs to document the coaching progress in skill and decision quality of an Investment Athlete. Our combination of prevention and intervention techniques enables individuals to strive for excellence, supported by an optimised decision design.

DISCIPLINES OF INVESTMENT ATHLETES

Our approach remains agnostic to investment strategies, AuM, asset class or geographic focus. It applies to more than 20 different profiles along more than 70 different skill dimensions, all relevant for professional investment management: portfolio managers, private bankers, analysts, board members, and many more. We work with both, individual cases and corporate teams and run as an open architecture, fully compatible to the existing training logic of the employer. This makes it equally beneficial for the professional as it is for the company itself.

WHO WE ARE AT A GLANCE

Do you want to become an Investment Athlete?

Talk to our expert and find out in 15 minutes what is the right solution for you or your team.