What have we been up to?

We have exciting news to share.

At Panthera Solutions we are continually aspiring to improve our solution to support investors in making better investment decisions. Your feedback allows us to implement innovative changes and above all make sure we continue to listen and understand your needs. This month we are proud to announce we have reached the following new milestones.

TREE UI/UX RELEASE

Did you know that our Panthera Tree is designed to save you time by improving your hit rate when making investment decisions? And now with this update, making these decisions is easier than ever. We are rolling out a new UI and UX that allows you to measure and analyse your investment decision quality even more intuitively, and in real time. Two examples.

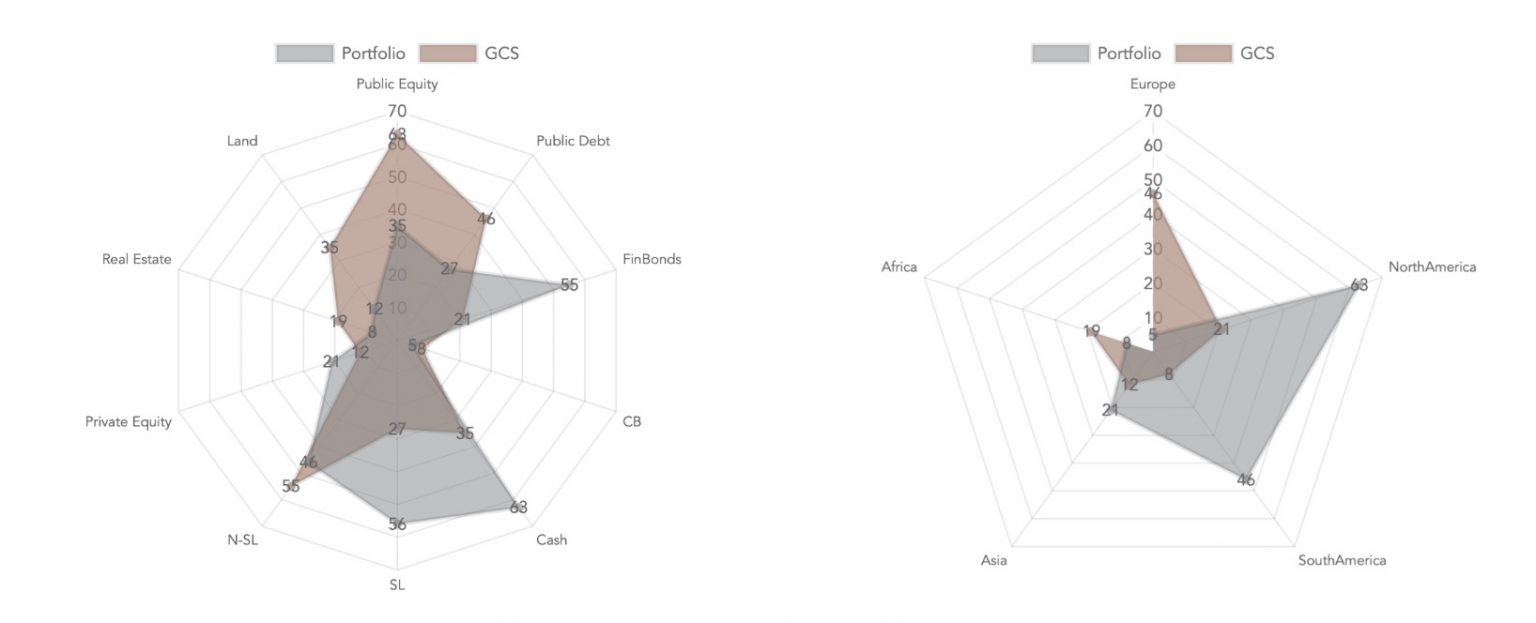

BENCHMARKING AGAINST GLOBAL CAPITAL STOCK

How does your multi-asset portfolio compare with the most neutral and reliable benchmark in capital markets? Use our new Cube feature to figure it out.

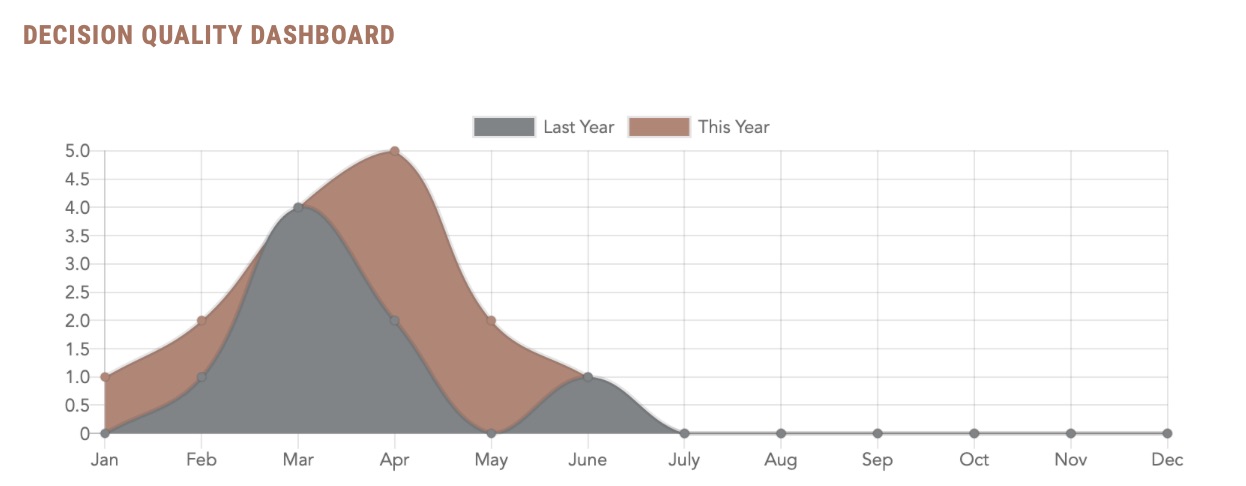

REAL-TIME DECISION QUALITY

Investment decision quality is often measured by performance – a weak indicator for whether your trades were driven by skill or luck. We have extended our Decision Quality Dashboard with new real-time indicators for you to instantly improve your hit rate.

TREE DEMO

You asked, we delivered. If you or your team would like a private demo of the Panthera Tree and its latest updates, please get in touch.

REQUEST DEMO

CFA INSTITUTE JOINT COLLABORATION

Our summer collaboration with the CFA Institute on 3 of our training offerings, gets underway at the end of June culminating on 7th July. These 3 popular training sprints are designed to get quality upskilling in a short 3-hour timeframe.

Participants will be able to choose between a morning or afternoon session depending on their schedule.

INFO & BOOKING

INVESTMENT MANAGEMENT SCHOOL IN JOINT PARTNERSHIP WITH EUROMONEY

The Investment Management School takes place virtually, early July (5th-6th) and is the most intense training, for designing a behaviorally optimized investment process. Over the two days you will learn how to:

• Configure an optimal environment for investment professionals to make the most rational investment decisions.

• Build a committee that produces the most evidence-based market assessments.

• Measure and interpret cognitive diversity among investment professionals.

• Use causality assessment tools to increase the SDG impact of your investments.

INFO & BOOKING